Bond Vigilantes May Deny Trump a Big Fiscal Win

Treasury market volatility here to stay

Tariffs look set to hurt the US economy. To prevent recession, the Trump administration needs big tax cuts, soon. But recent signs of an investor exodus from US assets suggest the price may be high. Volatility in the Treasury market looks here to stay.

Photo by Miguel Alcântara on Unsplash

“There is a price to pay for most of our actions. For every action, there is a reaction.” Giancarlo Esposito

Wall Street debate

The dust seems to have settled in financial markets after an eventful few weeks that began with the April 2 “Liberation Day” tariff announcements.

The first week’s turbulence saw ten-year US Treasury yields climb by 50 basis points, while the dollar lost ground against the euro by 4%.

As investors ponder these market moves, explanations range from the benign to the worrisome.

Some blamed the bond volatility on problems with the plumbing of the US Treasury market – nothing that, if push came to shove, the Fed couldn’t fix.

Others have sounded the alarm bells. They point out that the combo of both US Treasuries and the dollar – the safe havens of the global financial system –retreating is highly unusual. It could be a sign of international investors losing confidence in Uncle Sam’s full faith and credit. Ultimately, the greenback’s status as the world’s reserve currency may be threatened.

Between the two are those who see an end of US exceptionalism driving a rebalancing of investment flows out of American markets.

Meanwhile, on Main Street …

… tariffs are casting a long shadow.

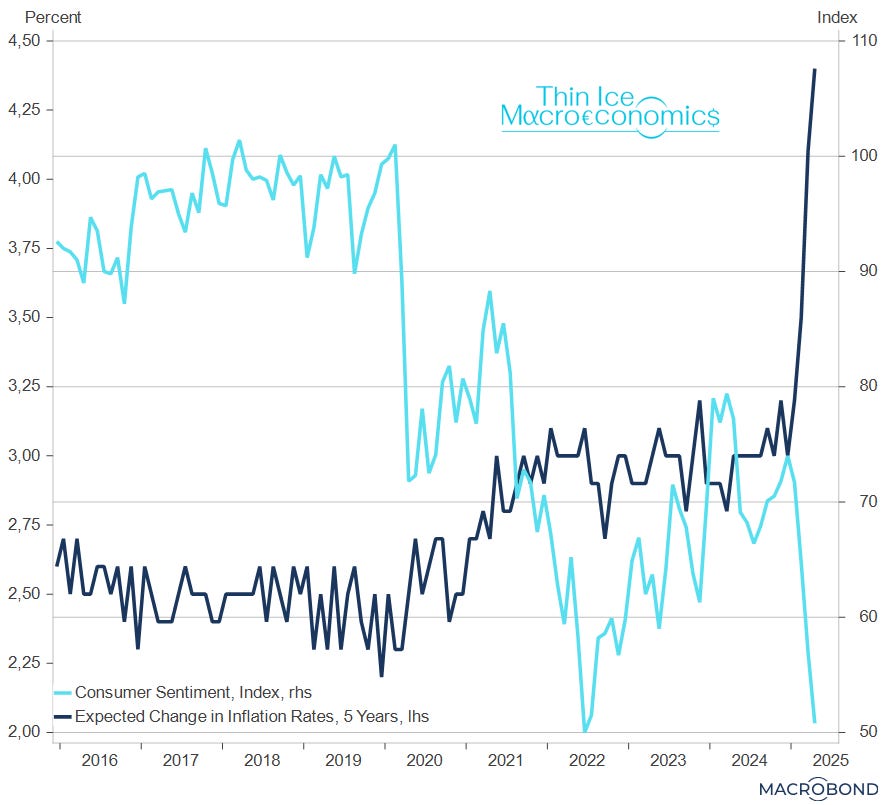

Even before being put in place, President Trump’s levies have clobbered consumer confidence and sent inflation expectations soaring.

source: University of Michigan, Macrobond

Once installed, dearer imports will eat into household income and corporate profitability, choking off demand. Business uncertainty and consumer anxiety will crimp spending further. Add stock market wealth destruction, and it’s no wonder some forecasters now reckon with a recession.

With mid-term elections just around the corner, the Trump administration now needs to score a big fiscal win to keep the economy on an even keel.

Simply extending the Tax Cuts and Jobs Act (TCJA) won’t do – that would just prevent a large fiscal tightening, but provide no fiscal impulse.

GOP congressional majorities have gotten the memo. The recently agreed upon budget resolution is aiming for another $1.5 trillion in debt-financed tax relief, on top of the $3.8 trillion already baked in from the TCJA extension.

What price is right?

But recent market moves beg the question: at what cost?

If global investors are rethinking their attitude towards US assets, convincing them to buy more Treasury debt won’t come cheap.

At worst, the newly awakened bond vigilantes could deny President Trump the fiscal win he so badly needs.

Unless of course the Fed comes to the rescue, perhaps because of a more pliant chair.

In any case, Treasury market volatility looks here to stay.