The data remains noisy, but recent releases have increased my conviction in a September cut - although it’s less certain than markets seem to be pricing. An October cut would require meaningful data surprises or an adverse (disinflationary) shock.

Photo by C D-X on Unsplash

I’m about to decamp for three weeks to a Greek beach – it’s Patrick Leigh Fermor’s stomping ground in the Southern Peloponnese for me this year, thanks for asking. But before I depart, I wanted to share a couple of thoughts on the broader backdrop for the ECB.

From the central bank’s perspective, the key characteristic of the situation remains the low visibility.

Data is noisy, politics remains a worry (with the focus moving from France across the Atlantic), “known-unknown” geopolitical risks are soaring, and central bank tectonic plates are shifting.

With all the other factors beyond the bank’s control, parsing the noisy data is key. As Christine Lagarde said: “I’m afraid it’s going to be a bit of a busy summer.”

The reaction function

But to frame the dataflow properly, we need to start with the ECB’s reaction function.

My reading of Christine Lagarde’s Sintra speech was that the focus of the ECB’s risk management approach has now tilted in a more dovish direction: towards growth, and downside risks to growth, instead of upside risks to inflation.

Above-target inflation is now seen as a mere residual risk. (While no doubt there are hawkish dissenters who have a different opinion – or at least are more cautious – about the balance of these risks, I’m assuming the ECB President expresses the views of the governing council median.)

That is, the formula is:

Confidence in inflation trend + downside risks to activity = easing bias

Which means that I’m inspecting the data through the lens of whether they challenge the governing council’s confidence in the inflation trend; and what they tell us about the skew of risks.

The trend in inflation is determined by the totality of the data – and will be summarized in the staff projections – very much in line with the ECB President’s important distinction between data dependence and data point dependence.

Noisy data

So what about the inputs to the reaction function – the data?

My summary of the recent releases is that while they shouldn’t have changed confidence in the inflation trend, the loss of momentum in the real economy is somewhat concerning, both for the expected pace of the expansion and for the skew of risks to growth.

Despite the uptick in the July flash consumer price inflation release, the downtrend should resume in August given base effects to the energy component. Not quite to be dismissed, the “optics” (stable core and a one-tenth decline in the services component to a still very high level of 4%) are tolerable.

On the activity front, things are more complicated.

French data has been all over the place. The fact that the INSEE and the PMI went in completely different directions suggests that the timing of data collection played a role.

The former’s was nearer to the immediate aftermath of the election and cratered, the latter’s was a few days later as well as closer to the Paris Olympics, and rose. Nonetheless, I’m not prepared to say with any degree of conviction that the uncertainty shock from the election will leave no trace. In any case, a clearer picture won’t emerge before the September business surveys published after the upcoming meeting.

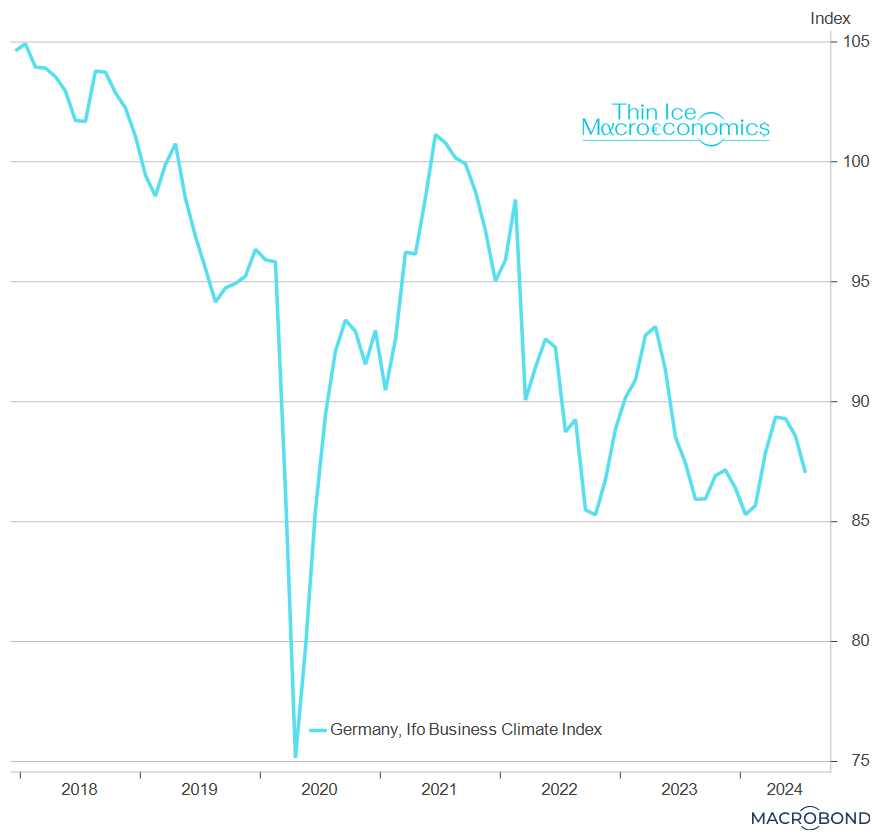

Meanwhile, in Germany … the economy just can’t catch a break. The renewed backsliding of the ifo which gained pace in July may also reflect some sentiment contagion from French politics, and even events in the US. But it is also indicative of a broader malaise which may be part psychological – an economists’ way of saying “I don’t fully understand it”!

Source: ifo institute, Macrobond

Euro area loses momentum. In fact, the manufacturing sector is struggling across the bloc. The slowdown in the services gauges adds to these worries. Still, I think services should continue to support growth, led by a continued recovery of real incomes supporting consumption. But the inability of manufacturing to rally is curtailing momentum.

Could the pullback in the July business surveys be the beginning of something more sinister?

Not necessarily, but as long as this can’t be ruled out entirely it’s probably fair to say that risks to activity have tilted a bit more to the downside. In any case, growth looks likely to fall short of the 0.4% non-annualized quarterly rate anticipated by ECB staffers for Q3 and Q4 (as well as having already fallen short in Q2).

September cut coming

All of this means that a September cut remains the most likely outcome, in my view. (It’s nonetheless a good job that they don’t pre-commit and stick to the “wide open” communication.)

At the time of writing, markets are pricing 57bp by December, with September and December essentially fully priced and about one in three odds for a move in October.

While I would call a September cut a reasonably strong central case, however, it shouldn’t be the foregone conclusion that markets seem to be pricing.

What needs to happen for an October cut?

In any case, the more interesting question seems to be what the chance is for a fourth cut this year.

First off, nothing constrains the ECB to moving only in synch with the staff projections in the final month of each quarter.

The quarterly rhythm that the governing council by implicit agreement seems to have defaulted to makes sense in an environment where

uncertainty is sufficiently high for the staff forecasts (and the implicit internal consensus-building exercise that they entail) to provide added value for decision-making; and

disinflation towards the target is sufficiently “slow” and developments in the economy are sufficiently orderly to allow proceeding at a steady pace of one cut a quarter.

Combining this with the reaction function that I laid out above provides an answer to the October question: a cut would require abrupt changes in inflation (-related) data that strongly call into question the trend on the downside; and/or signs that the bottom may be falling out of the real economy – i.e. a mere muddling through at subdued growth rates would probably not be sufficient.

The former seems unlikely in the near term given the stickiness in services inflation as well as the current (and prospective strength) in wages. The risk of an outright slump in the economy may have increased somewhat, but would probably require a new shock.

In short, at about 30% the risk of an October cut seems amply priced already.

Beyond October

Further afield, I remain concerned that the ECB’s assumptions on wage growth remain too optimistic. President Lagarde in the July meeting expressed a very high degree of conviction in wage growth declining as required for inflation to revert to target by the end of next year. I have my doubts.

I reckon that even a more subdued recovery would not be enough to re-establish the connection between economic activity and employment: structurally tight labor markets underpin a stronger bargaining position for workers, which will continue to drive an increase in workers’ share of the pie (wages in % of income - see Chart), suggesting continued wage pressures.

Source: Eurostat, Macrobond, Thin Ice Macroeconomics calculations

What’s more, productivity continues to disappoint.

Put differently, the ECB is likely to have to maintain tighter policy than the market anticipates to keep wages (and profits) in line with the target. If market pricing is for essentially 125bp of cuts by June 2025, that is, for a level of 2.50%, I remain very comfortable with 2.75%.

To be clear, this is the central case.

A key negative scenario is of course the US Presidential election.

I don’t think I’m breaking any new ground by saying that Trump 2.0 would be bad news for the euro area economy: new tariffs on China (and/or a trade war) would be sufficient for that, even without considering frictions in the bilateral trading relationship between the US and Europe.

Overall, a Trump redux would – at least in the near term – be net disinflationary for the euro area and hence broadly dovish for ECB policy, in my view.

I hope to see you all in September!