Divergence Divide

Labor markets will determine the divergence in policy rates between Fed and ECB.

Bottom line: the US labor market easing should eventually allow the Fed to cut; structural tightness of the euro area labor market will make the ECB stop cutting; although we’re not there yet by any means. But after divergence comes convergence.

One major debate in financial markets concerns the extent to which the European Central Bank is dependent on – or constrained by – the Federal Reserve when it sets interest rates.

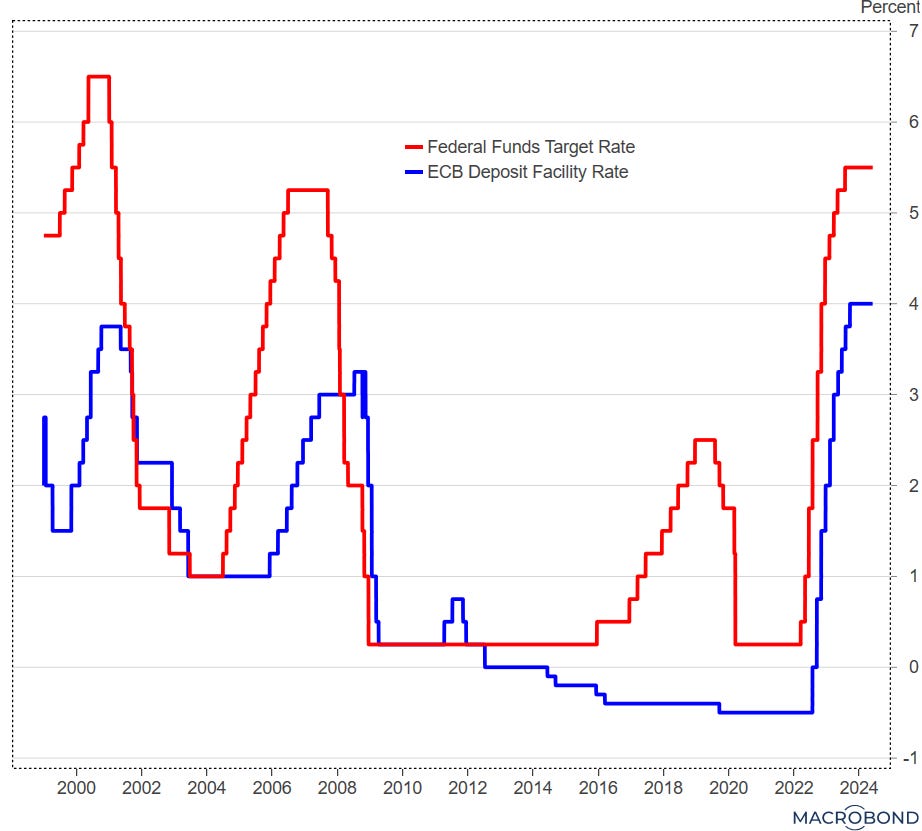

I think this stems in part from the fact that it’s easy to over-interpret the correlation between policy rates on the two sides of the Atlantic (see chart below). Much of it comes from large common shocks such as the Great Financial Crisis in 2008-09, the pandemic, and the inflation shock that followed it.

source: Macrobond, Federal Reserve, ECB

A fair amount of run-of-the-mill global business cycle synchronization – our common fortunes in an interconnected global economy – certainly also contributes to the correlation. Naturally, that defines limits to any degree of divergence possible.

But I think that the Fed-dependence of the ECB is often overstated.

The limits to the policy rate divergence between the Fed and the ECB will not be determined by some “unwritten law” that says the ECB can’t move rates unless the Fed does (this one will be refuted next week anyway, as the ECB is poised to deliver its first rate cut while the Fed stands pat).

Neither are exchange rate effects – any depreciation of the euro against the dollar that would result from the ECB going solo – that large. I reckon a 10% depreciation of the euro against the US dollar should add around 0.2 percentage points to inflation over two years. That is completely dwarfed by the contribution of domestic factors to inflation pressures.

And therein lies the rub. It will be the relative trajectory of those domestic inflation drivers that will ultimately determine the degree of divergence.

The key for that is labor markets. A good summary indicator of labor market tightness to watch is the ratio of job vacancies (or job openings) to unemployed workers.

source: Macrobond, European Statistical Offices, ECB, BLS

As the chart shows, in the US the labor market is becoming less tight. The labor market reasserting its influence over inflation is just a matter of time (indeed it is already happening) in my view - provided the Fed stays restrictive long enough. The euro area economy on the other hand is embarking on a cyclical recovery without the labor market having eased that much over the previous quarters.

That’s because in the euro area, labor market tightness is “structural” to a much greater extent than in the US, owing to

adverse European demographics

mismatch between the skills sought by employers and those supplied by workers

and, I suspect – it’s difficult to come up with timely numbers for Europe in particular – less immigration.