European Risk Redux?

Crisis fears are exaggerated, but investors are likely to stay cautious on European assets.

While concerns of a renewed crisis are exaggerated, European investors are confronted with potentially prolonged uncertainty and a return of tail risks. In the hypothetical scenario of a far right government in France questioning the EU policy framework, activation of fiscal and monetary (ECB) “firewalls” become more challenging. Investors are likely to remain cautious on European assets.

There’s never a dull moment in Europe.

European financial markets have been unsettled by French President Emanuel Macron’s announcement of a snap parliamentary election.

The press highlights the possibility of France’s far right entering government, possibly with the left as largest opposition force. Both have large unfunded spending plans. With the UK’s bond market turbulence under Liz Truss a recent memory, investors are concerned.

Another worry in markets seems to be whether a potential far right governmental majority emerging from these elections could become a ramp for the party winning the presidential election in 2027.

Fundamentally, investors’ worries about France’s far right can be summarized in one sentence: France’s far right questions the European policy framework.

Once bitten, twice shy?

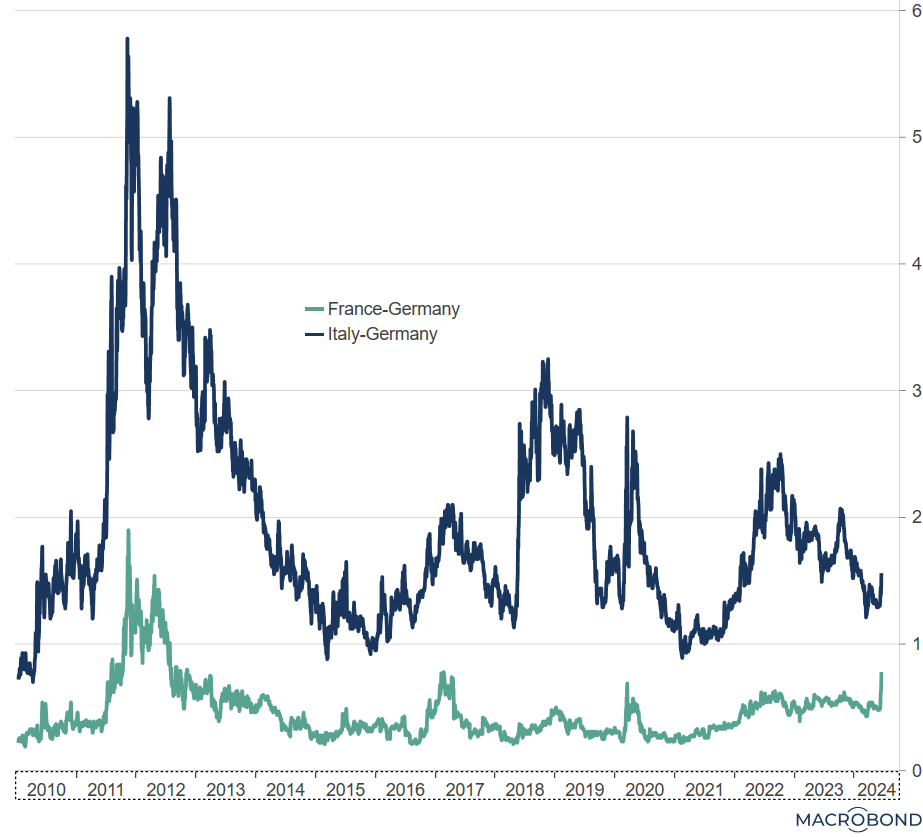

As a result, there is even talk among market participants about the possibility of a renewed European crisis, with some scenarios being discussed including France’s exit from the EU and a breakup of the common currency. Many recall the euro area financial crisis - even as the increase in ten-year bond spreads over Germany is but a blip in the greater scheme of things.

source: Macrobond

My own view: these fears are overdone.

Even the worst case scenario of a far right presidency would not result in “FRexit” - not least since France’s far right itself is no longer advocating it. (To readers who may want to challenge this assertion on the grounds that Brexit was also unthinkable, I would say that the UK’s attachment to the European integration project – economically, politically, and culturally – was always looser.)

Nor would a far right victory in the parliamentary elections automatically mean a fiscal crisis, as many seem to think.

That said, even a strong degree of conviction on the eventual outcome may not amount to sufficient reassurance for investors right now:

there is the potential for prolonged uncertainty - that is, the path to the benign outcome could be bumpy, and

investors perceive a return of tail risks in Europe - FRexit and/or euro breakup.

Potentially prolonged uncertainty

First off, unless the outcome of the French parliamentary election in June/July is obviously “market friendly”, France and Europe could enter a period of prolonged uncertainty.

Just a few of the questions the emergence of a far right government would raise: what happens to French fiscal policy? What happens with France’s relationship with its European partners, and European institutions? How will EU institutions themselves function, since governments need to agree on the now vacant leadership posts? What would a potential far right victory in the parliamentary elections imply for the possibility of the party winning the 2027 presidential election?

Quick refresher: euro area crisis-fighting framework

Second - and this relates to tail risks - what would happen in a potential “crisis scenario” (however low a probability one may attach to it)?

In response to the 2009-2012 euro area financial crisis, Europeans established a crisis-fighting framework involving two main pillars.

Fiscal “grand bargain”. For all the messy detail, Europeans reached political compromises involving the so-called “core” economies (Germany, France, Netherlands and others) extending their credibility and robust fiscal balance sheets to the so-called “peripheral” economies, in exchange for economic reforms that would improve the latter’s economic competitiveness.

That was the principle behind bailout loans for Greece, Ireland, Portugal, Spain, and Cyprus.

I see the pandemic-era invention of the Next Generation EU fund as a continuation of the same approach. In this case, the EU as a whole issued debt to fund grants to countries, with relatively weaker countries being net recipients of funds. Disbursement of the funds in turn is linked to reforms and specific investment projects (although the conditionality is much lighter than for bailout programs).

ECB intervention. Invariably, financial markets are faster to sell off than political leaders can fashion compromises. As a result, the ECB has been the tip of the spear of euro area crisis fighting. Crucially, the ECB is unique among all actors in that it has potentially unlimited firepower (the central bank’s monopoly of liquidity creation), and the ability to unleash it instantaneously in financial markets.

Former ECB President Mario Draghi’s so-called Outright Monetary Transactions (OMT) are the prime example of such an intervention. Launched at the height of the euro area debt crisis in 2012, the ECB promised to buy potentially unlimited amounts of a country’s debt, subject to the country’s government agreeing to a bailout.

It worked without the ECB actually buying a single euro’s worth of euro area sovereign debt under this program. Markets saw it as credible, and backed off.

A similar principle is at work with the ECB’s more recent Transmission Protection Instrument (TPI), launched in 2022. I belong to those who think that the TPI is one of the elements that contributed to well behaved sovereign spreads for peripheral economies during a time when the ECB embarked on the most aggressive tightening cycle in the history of Europe’s monetary union. (The other element being the economic outperformance of peripheral economies.)

Uncharted territory?

Would this framework work again in a hypothetical French crisis scenario?

That’s where there is potential lack of clarity. Two things could turn out to be different in the eyes of some market participants.

Core problem. Investors now see a potential for ructions in the “core” of the euro area, rather than the “periphery”. With a fifth of euro area GDP, France is the common currency’s second largest economy. Together with Germany, the country is a major political driving force in the EU. France has always been part of the solution, not part of the problem.

Framework doubts. France’s far right – at least so far – questions Europe’s policy framework. And both pillars of the crisis-fighting framework I just laid out rely on governments accepting it.

This is obvious for the fiscal pillar. By definition, any bailout requires a government to sign up for it.

But it’s also true of the monetary one. Both ECB “firewall” programs, the OMT and the TPI, require a government comply with EU rules.

Activation of the OMT requires conditionality in the form of an outright bailout program or a - softer - precautionary program.

The ECB’s TPI press release is quite explicit that the ECB can buy if a country experiences a worsening of financing conditions that are “not warranted by country-specific fundamentals” [my italics]. Its criteria for purchases of a country’s bonds include

compliance with the EU fiscal framework including the country not being in an Excessive Deficit Procedure (EDP). Yet France (along with Italy, Belgium, perhaps Spain, and others) is likely to be placed under an EDP within a few days - even before any hypothetical far right government takes the helm;

fiscal sustainability, ascertained on the basis of debt sustainability analysis carried out by European institutions and potentially the IMF.

Again, none of this means that a crisis is coming.

Nor does it mean that - in a hypothetical scenario of market or political tensions - there won’t be ways to resolve them eventually.

But it does mean that activating the existing backstops in the European framework cannot be taken for granted to be smooth, or immediate. It would depend - by more than usual - on politics, i.e. on the attitude of France’s far right. That’s why I think it’s likely investors will stay cautious on European assets.

The euro doesn’t like political risk

Overseas investors in particular tend to be easily spooked by the complexities of European politics. This could show up in the currency.

In general, the exchange rate of the euro doesn’t metabolize political risk well - whether the risk is external, or internal. It has not recovered from Russia’s invasion of Ukraine, for example. The chart below shows that the euro exchange rate against the dollar is much weaker than the predicted value from a regression on the two-year US-Germany yield differential (this regression being very primitive econometrics, take the numerical value of the gap between predicted and actual with a large pinch of salt!).

Excellent analysis, and I agree across the board. Most interesting for me is how the Eurozone is trying to address an obvious moral hazard problem: As you say, fiscal solidarity and the ECB "protection" have been extended to weaker EZ members in exchange for fiscal and structural reforms that have never materialized. To mitigate this, we now have the requirement that, in order to benefit from ECB support in case of market pressure, a country should be in compliance with the EU fiscal framework. Of course, if financial market pressure were to threaten the financial stability of a non-compliant member, I believe a way will be found for the ECB to step in anyway. As you correctly suggest, this would however take more time and uncertainty, creating buying opportunities as markets get spooked. It would however then make the moral hazard problem worse, and reduce chances of reform even further -- and I'm not sure I can see a way out of this problem. The result would seem to be an outlook of "fragmented fiscal dominance" where ECB policy is to an extent hostage to the fiscal irresponsibility of some large member states.