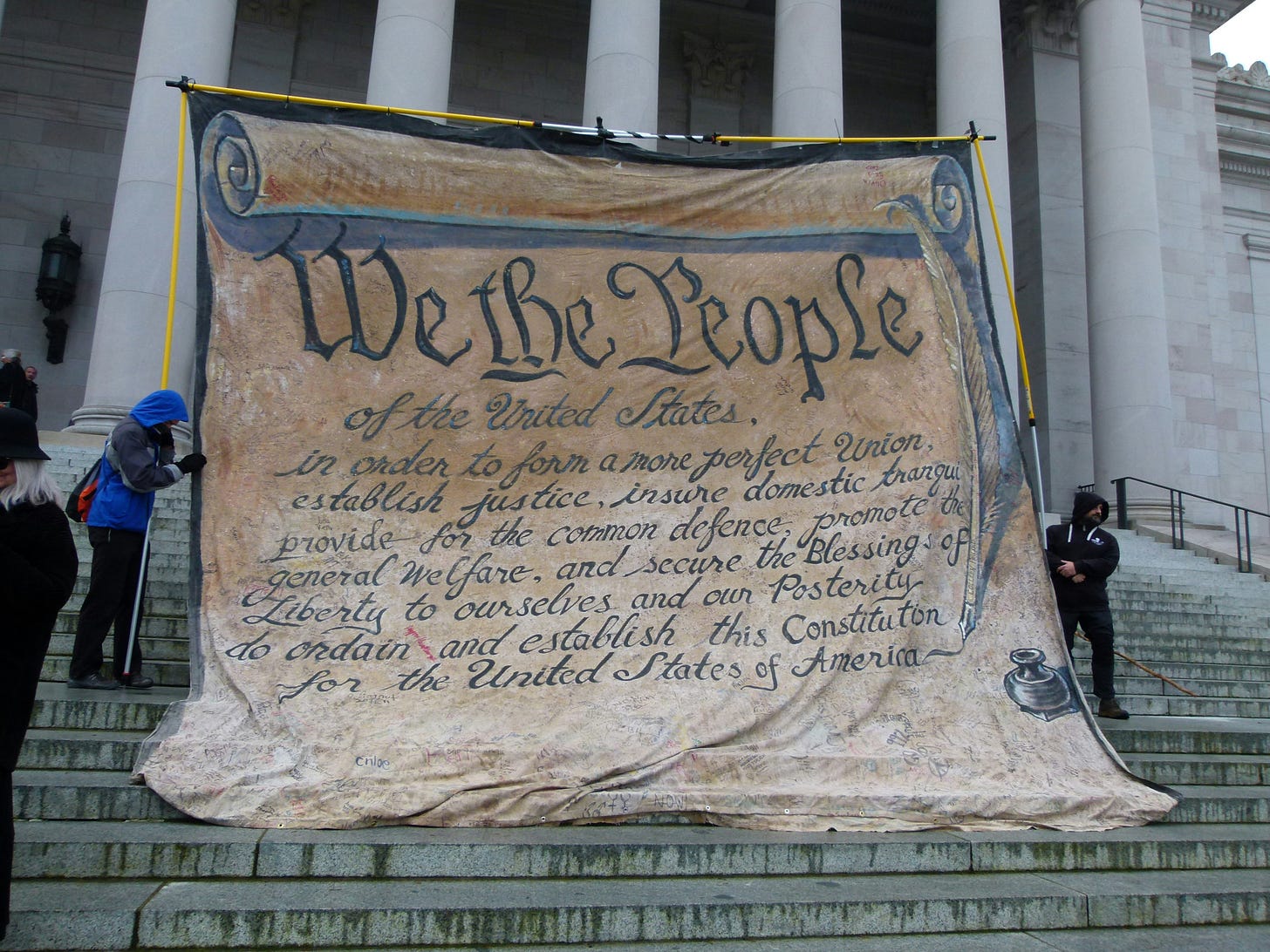

We the People vs Capitalism

Trump, investors, the Fed, and the dollar

The dominant currency status of the dollar allows US fiscal policy to operate under fewer constraints (“exorbitant privilege”). Then, however, the Fed must be independent: reserve currency status in a fiat money regime requires monetary dominance. This reveals a fundamental tension between MAGA (as well as some interpretations of the US constitution) and investors. The latter prefer constraints on the executive – for example, independent government agencies such as the Fed – while the former reject them.

Photo by Larry Alger on Unsplash

“He who saves his Country does not violate any Law.” Donald J. Trump

Dollar danger

There have been some bad omens of late in financial markets concerning the dollar’s dominant currency status.

Following the Trump tariff announcements the dollar depreciated, while Treasury yields (and market volatility) rose – a highly unusual correlation.

source: ICE, Federal Reserve, Macrobond

While I don’t think that the dollar is going to lose its status anytime soon, if only due to lack of alternatives (see my scorecard on the euro as a reserve currency), the above are signs that the dollar’s status is eroding: this time is different.

Policy uncertainty vs framework uncertainty

To understand what’s going on, I want to start by making a distinction regarding the Trump administration’s conduct.

Erratic policy making (and communication) out of the White House have resulted in an increase in policy uncertainty, particularly on trade;

Yet the administration also seems to reject, or at least seriously challenge, the broader policy framework, which gives rise to framework uncertainty.

source: Matteo Iacovello, Macrobond

I believe markets would have been able to cope with the former – essentially, this was Trump 1.0 – even if dialled up considerably.

It’s framework uncertainty where the threat to the dollar’s status comes from, in my view.

Financial markets exist to price uncertain future cash flows. They can’t do that if the rules of the game are unclear.

Democracy vs capitalism

To me, ultimately the problem arises out of a fundamental tension between democracy and capitalism – or at least, between the MAGA movement and certain interpretations of the US constitution on the one hand, and investors on the other.

Investors don’t like uncertainty, which is why they are willing to pay a premium for assets backed by a predictable policy framework (and need to be paid a risk premium to hold assets that are not).

A predictable policy framework by definition limits policy discretion (loosely, the ability of policy makers to act “as they see fit” at any point in time), which means that it places constraints on executive power.

The MAGA movement on the other hand, and on some interpretations the US Constitution itself (see below), rejects constraints on the executive.

This is crucial in the US context because the exorbitant privilege means that fiscal policy operates under looser constraints than in other countries.

Bubbly exorbitant privilege …

According to Markus Brunnermeier, a brilliant Princeton financial economist, and his co-authors:

Issuing the safe asset lowers the issuer’s interest burden. Because the safe asset appreciates in value when something bad happens (safe haven), holders derive a non-monetary benefit from owning the safe asset (the “convenience yield”). In turn, this means the asset has a lower monetary return.

Since Treasuries are a safe haven, the fiscal space of the US federal government increases in recessions.

US Treasuries can be a bubble: the safe asset is safe because that’s what everyone perceives it to be (“safe asset tautology”). The good news here is that the government can run a permanent primary deficit without ever paying back its debt (if the interest rate is below the growth rate). The bad news is that the safe asset status can be lost when the bubble pops.

… requires an independent Fed

As far as I’m concerned however, if the constraint on fiscal policy is looser, then there must be a constraint on monetary policy. This ought to be a necessary condition for the bubble not to pop.

Which means that in the end, dominant currency status in a fiat money regime requires monetary dominance – the Fed being willing and able to set interest rates in order to control inflation rather than to help the Treasury make the debt sustainable.1

And a necessary condition for monetary dominance is Fed independence.

Government vs governance

Back to the fundamental tension between capitalism and democracy – or MAGA and investors.

Any independent government agency is, by design, a constraint on executive power.

The question of how much power independent government agencies should have – or whether such agencies should exist at all – is an important constitutional as well as political question for any democracy.

Government must be accountable to the people, and the way that works is via an elected executive. To me, this principle implies that any exception must be: (i) limited, (ii) tightly circumscribed; (iii) carefully justified, and of course (iv) decided upon by the representatives of the people themselves.

Which means that reasonable people will disagree on the existence, scope, and justification of such exceptions.

In practice, a polity gives up some executive power – it makes its government less powerful – in order to achieve better governance. This is the overarching principle behind central bank independence: an independent central bank delivers better outcomes (at least in the long run).

The courts, MAGA, and the Fed

Inevitably, the extent to which a society will find independent agencies desirable is not etched in stone, and indeed may change over time with laws – or the interpretation of laws.

Currently, in the US, the legal pendulum appears to be swinging towards more executive power -

has an explainer that I highly recommend.That’s why investors are so focused on the Supreme Court cases concerning presidential powers to dismiss the heads of independent agencies, and their potential read-across for the Fed.

And then there’s the MAGA movement itself.

As I said at the outset, investors very much want a constrained executive.

For example, investors tend to want their money back. Which means they like the executive to respect property rights – that’s a constraint.

Chairman of the Council of Economic Advisers Stephen Miran’s proposal to term out the reserve holdings of US allies quite simply amounts to a default - and therefore infringes on bond holders property rights.

Investors may found out soon if those simmering tensions come to the boil.

I’m saying “in a fiat money regime” because under the gold standard the disciplining element for policy would have been gold flows. Unsustainable policies would result in outflows of gold from the dominant economy, forcing a change in policies as it would otherwise run out of gold reserves.