Dispatch€s from Frankfurt: ECB: Rates Cut While U Wait

... for the trade negotiations

Not much has changed since the April meeting for the ECB – uncertainty still reigns supreme. Which means that besides the probable 25bp cut on June 5, communication should remain broadly dovish despite a likely non-committal statement on future rates (and the absence of guidance on a July pause). A 50bp cut – including intermeeting – remains an option, although an outside one, likely to be exercised only in case of disorderly developments on the trade front and/or in financial markets.

source: Charlotte Venema on Unsplash

“Exceptional uncertainty” persists

What’s changed since the April meeting?

There has been a deal, of sorts, between the US and China, possibly averting a collapse in bilateral trade between the two economies. On the other hand, Trump has threatened, and then withdrawn, 50% tariffs on the EU. The result of the negotiations will likely not be known until the July ECB meeting.

Meanwhile, the fresh ECB staff forecasts to be unveiled are likely to show faster convergence of inflation to target as energy prices have fallen and the euro has strengthened – essentially, the forecasts are likely to “catch down” towards the latest European Commission forecasts.

Source: Bloomberg

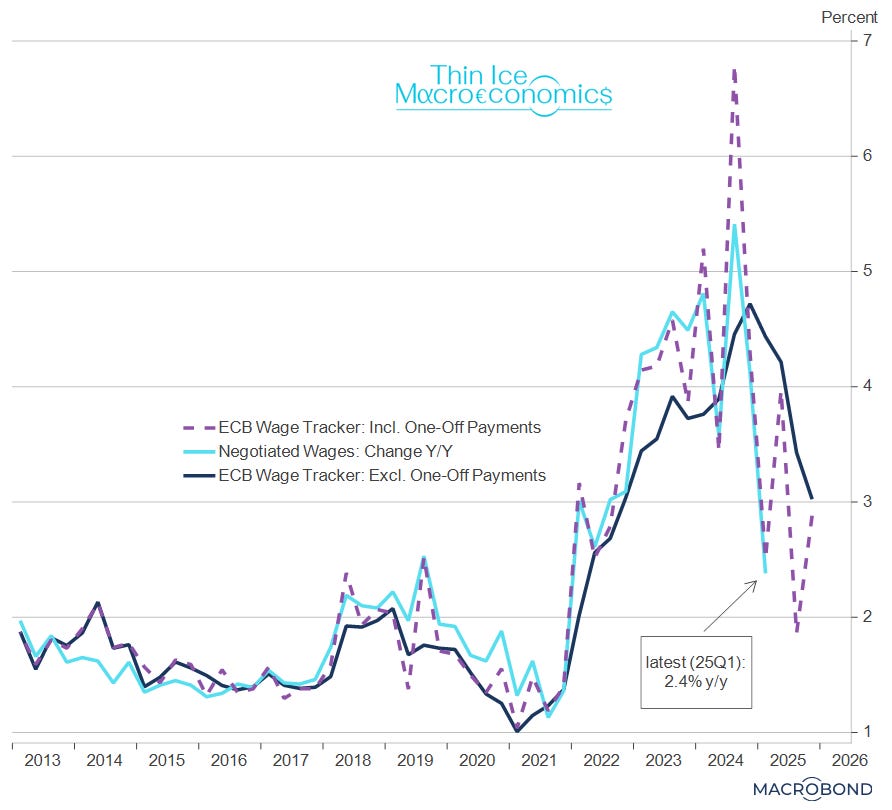

While services inflation remains stubborn, benign wage data together with the ECB’s own forward-looking metrics have increased confidence at the ECB that it, too, will budge. In fact, some governing council members have started to see risks of inflation undershooting the 2% target.

source: ECB, Macrobond

The downside risks to growth that the March forecast round had flagged have also materialized with Trump’s trade war – while it’s unclear where tariffs (vis-à-vis the EU, and everybody else) will eventually settle, it is virtually certain that they will be higher.

In sum, this calls for steadiness in the face of high uncertainty.

Steadily towards another cut

Indeed, the outcome of the June meeting is already well-telegraphed: another cut in the deposit facility rate to 2.00% looks very likely.

Not surprisingly, ECB governing council members’ thoughts have gone beyond the upcoming meeting. Bank of Greece governor Yiannis Stournaras (considered dovish) has suggested that the council will cut in June and pause in July.

Taken together with National Bank of Belgium governor Pierre Wunsch (considered hawkish) saying that the ECB may go slightly into expansionary territory (to be understood as rates below 2.00%) suggests that my expectation for a 1.75% in September remains on track.

Downside risks to 1.75%

That said, I now think that risks for my 1.75% terminal rate forecast are to the downside.

Besides the Trump tariff threat, there is the potential for further appreciation of the trade weighted euro as investors reconsider their exposure to the US.

What’s more, I’m concerned about a delay in German public investment coming online: the chart shows the budget balance of German local authorities (who carry out 50% of gross infrastructure investment) against their investment spending. Last year’s dismal financial situation for local councils suggests likely underperformance for this year’s investment spending.

source: German Federal Statistical Office, Macrobond

For further detail, interested readers may want to have a look at my deep dive into German public investment and in particular the various impediments to local authorities’ infrastructure spending.

Communication: the song remains the same

There is little reason for Christine Lagarde to change the “readiness and agility” communications formula introduced in the April meeting.

It is clear that the ECB will not (and should not) pre-commit on any particular rates path – as its statement is likely to repeat – so that data dependence remains the name of the game. This is particularly the case at times when macroeconomically significant tariff barriers have been erected and there’s the threat for more.

That said, the tone of the press conference should still tilt dovish overall given the general backdrop: inflation is converging to target with risks to the downside at least for the near term, while there are still risks of a substantial escalation of the trade tensions with the US.

This also means that while a pause in July is likely – barring unpleasant outcomes in the trade negotiations with the Trump administration – the official statement should not necessarily guide for a pause in the next meeting: no precommitment cuts both ways.

How likely is a 50bp move, in general?

I still think that unless there are reasons to believe that the real economy fallout from US tariffs will turn out to be disorderly – which shouldn’t be the case in a reasonable scenario of a deal of sorts – there is no obvious need for a larger move, although Christine Lagarde is likely not to rule anything out.

If, on the other hand, we see an escalation, then all bets are off. Particularly in case the market response is severe, then both a 50bp cut and an intermeeting move become conceivable.

Interesting times.

Thanks Spyros for another insightful post. Do the hikes in steel and aluminum tariffs fall in the realm of the escalation that you have stressed in the piece?

This is a well-argued walk through the ECB's increasingly narrow path. Between lagging German investment, a strengthening euro, and Trump’s tariff unpredictability, the downside risks to the eurozone economy—and to the ECB’s terminal rate—are real. Really solid analysis!