Recent developments in the US and Europe are changing investors’ relative perception of the two currency areas, even raising the question of whether the euro could become the world’s predominant reserve currency. I remain sceptical: my report card for the euro suggests it will not be able to replace the dollar by merit anytime soon. However, the euro may now be poised to benefit the most from any US missteps that damage the dollar’s standing by default rather than by merit, and increase its reserve market share.

source: ChatGPT

Doubts about the future of the US dollar as the world's reserve currency traditionally emerge during periods of dollar weakness.

Not so this time. The dollar is reasonably close to its long term average (in nominal terms), yet investors have started to think the unthinkable.

source: ICE, Macrobond (grey shaded areas: NBER recessions)

No prizes for guessing why, of course.

The US administration appears to be treading a fine line between wanting to maintain the dollar’s reserve currency status – judging for example from Trump’s statement that the US would punish countries who move away from its use – but wanting to change the rules of the game, for example by reprofiling outstanding Treasury debt.

What’s more, the administration’s at best half-hearted commitment to the dollar’s status seems embedded in a broader philosophy calling into question both America’s willingness to remain the world’s superpower and its ability.

This is further compounded by market-unfriendly, erratic economic policy making hobbling confidence in both the US economy and financial markets.

All of this occurs against a bigger picture of a gradual, long term downtrend in the dollar’s share of official reserves.

That said, – at least prior to the arrival of the second Trump administration – this long term decline did not seem obviously concerning for the dollar’s status: while there is partly a genuine decline in dollar preferences, no doubt at least partly due to geopolitical reasons, there are also more pedestrian reasons such as a composition effect related to Switzerland accumulating euros, and plain old diversification.

source: IMF Blog

Has the euro’s time come?

In any case, the notion that the euro might eventually replace the dollar as the global reserve currency has received renewed impetus recently.

MAGA conduct and intentions has been one side of this coin.

The other has been the re-invigoration of the EU, as the abrogation of American global leadership has spurred Europeans’ self-preservation instinct.

This has manifested itself in the greatest German fiscal effort in a generation, as well as a broader drive towards European integration which may even result in joint issuance.

So, should we roll out the red carpet for king euro?

Not so fast.

It’s true that in the long term, the shares of euro and dollar have – inevitably – tended to move in opposite directions (note the different axes!).

source: IMF COFER, Macrobond

To assess the plausibility of the euro’s claim to the top spot, I construct a report card for the euro. The marks will be given relative to the – as yet – best in class: the dollar.

Report card for the euro

1) Institutional framework and the rule of law, safety of government liabilities. The recent deterioration of governance and the rule of law in the US automatically makes Europe look better – after all, with currencies, everything is relative.

It has escaped nobody’s attention that some parameters of the proposed Mar-a-Lago Accord – like “terming out” Treasury debt, or swapping it for one-hundred year zero coupon bonds – would amount to a credit event (and indeed would be a bad idea altogether).

Of course, the euro area is no stranger to government default.

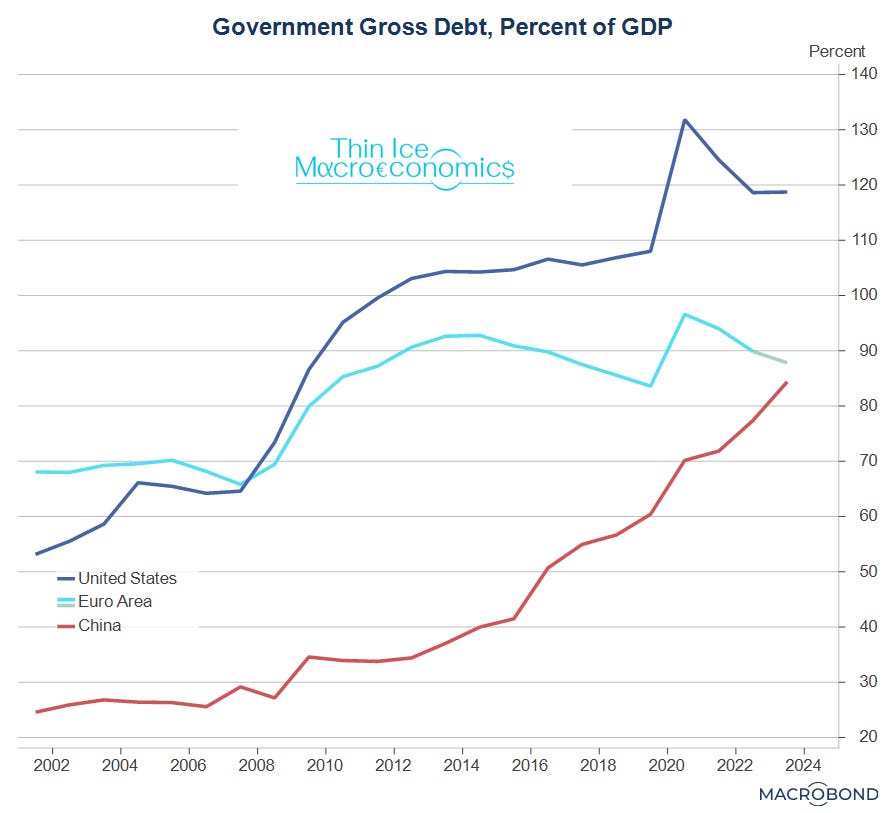

More importantly, although the euro area’s aggregate government debt-to-GDP ratio is lower than the US’, its distribution across countries makes for fiscal fragility.

On the other hand, even after Germany’s fiscal splurge was announced, financial markets have not changed their view of Bunds as a safe asset.

GRADE: C – SATISFACTORY.

source: IMF Fiscal Monitor, Macrobond

2) Government bond market size, depth, and liquidity. Staying with the German fiscal announcements, adding about one trillion euros of debt will greatly add to the size, depth, and liquidity of (the safe portion of) the European government bond market. That said, the market remains fragmented along national lines due to credit risk differentials. The prospect of renewed joined issuance – call it NGEU 2.0 – would make for further improvement along this dimension.

GRADE: B – GOOD.

3) Size and integration of economy. If the institutional framework and safety of assets was sufficient, the swiss franc would be a global reserve currency. Instead, its share of allocated reserves is around 0.2%. The size of the economy therefore matters, as does the degree of integration of its internal market. Here, Europe needs to do much better.

GRADE: D – NEEDS IMPROVEMENT.

4) Economic growth (potential) and technological leadership. Amidst all the excitement about Germany’s fiscal package (which I share), it sometimes feels like markets have forgotten the supply side.

True, Europe’s economy has been demand-deficient for a long time, and running its economy hot should help with supply as well. The domestic demand push will help rebalance the economy away from exports and reduce its current account surplus, which will help with reserve currency aspirations.

But Europe’s deficiencies on the supply side remain glaring.

The same is true for its ability to innovate or, more broadly, its distance from the technological frontier – which is the US.

Being at the technological frontier, by driving growth and productivity, also helps fiscal sustainability, an important assumption underpinning global reserve currency status.

What’s more, technology determines important aspects of sovereignty, such as internet and social media platforms (and the markets related to them); the quality and profit margins of your manufacturing production (let’s summarise that as the “competitiveness” of your tradable goods sector); and your ability to defend yourself with state-of-the-art weapons.

Last, but by no means least, it also attenuates the so-called Triffin dilemma that MAGA economists are anxious about.

The Triffin dilemma says that it becomes ever more difficult for the supplier of the reserve currency to sustainably issue the amount of liabilities the global economy needs if its share of global output declines (as was the case for the US until the mid-2010s).

Europe, instead, is currently struggling to innovate its way out of a mid-tech trap.

GRADE: E – FAIL.

All of the above means that on merit, and despite recent improvements, the euro would struggle to compete with the dollar for the top spot of reserve currencies.

At the same time, because of recent improvements, the euro would be positioned by default to benefit if the dollar were to fall off its perch, increasing its reserve market share.

MAGA may yet see to that, whether by intention, or not.