Dispatch€s from Frankfurt: Zugzwang: ECB to Cut in October

And in December

Photo by Randy Fath on Unsplash

Zugzwang /ˈʦuːkʦvaŋ/ noun (chess) – pressure to act

Summary: I now expect the ECB to cut by 25 basis points in October (as well as another 25bp in December).

“When the facts change, I change my mind. What do you do, sir?” attributed to John Maynard Keynes

Following the poor September PMIs for the euro area I felt that the ECB should cut rates in October, but wasn’t convinced that they would. I now think that they will.

Here’s why.

Rewinding the tape

It’s useful to recall the recent path of ECB communication (apologies if this seems a bit self-indulgent).

Sintra in my view marked a shift in the ECB’s reaction function in a more dovish direction, making the ECB more attentive to growth, and to downside risks to growth.

Yet for October to be in play, I thought that a new shock was required, resulting in a more meaningful deterioration in growth (an input into the reaction function). By the time the September meeting came around, I thought the deterioration in the data was sufficient for a rate cut discussion ahead of October to gather pace.

However, the September meeting did not in any way acknowledge the deterioration of the growth outlook and/or more pronounced downside risks to growth, suggesting that the bar for a rate cut was higher than I thought. Post-meeting – and even post-Fed – this was still the broad thrust of the ECB’s communication.

Then the PMIs (and the German ifo) deteriorated further.

Given how high the bar seemed to be, I wanted to hear “hawks” signal more openness. Isabel Schnabel’s presentation Friday (compared to another she gave a week before) is such a signal, in my opinion.

Looking ahead

Is an October cut a done deal?

By no means.

Inflation outcomes for September will start trickling in from Monday, 30 September.

President Lagarde had warned markets in the September meeting that a decline is already expected by the ECB on account of base effects in the energy component. Given elevated ECB anxiety about services inflation (clocking in at above 4% in the annual rate and in terms of momentum on a three-month basis – albeit declining), that’s the bit to watch – and it could still change things.

source: ECB, Macrobond, Thin Ice Macroeconomics

That said, Christine Lagarde and other governing council members have been very vocal lately that they are satisfied the trajectory of wages is compatible with inflation returning to target by the end of 2025.

Incidentally, I’m not convinced of the logic behind a potential “deal” mentioned in the press, whereby there would be no cut in October in exchange for a pre-announcement of sorts for a December move.

First, this backfired in June. Second, it makes more sense to cut now and not cut later, if it turns out that inflation isn’t declining fast enough, rather than risk being late and entertaining an undershoot of inflation eventually.

Nifty fifty in December?

Provided the ECB does not cut in October, I think pressure will mount for a 50bp move in December. A 50bp cut is possible in my view if it transpires that the ECB is decisively behind the curve at that point.

(Indeed, some members may be convinced to go along with a cut in October to forestall the possibility of having to do 50 in December.)

While I don’t expect a proper recession, I don’t think eurozone surveys have bottomed in September. Germany in my view is in a confidence recession, a case where concerns about structural challenges and policy (and politics) uncertainty have infected business and consumer sentiment. (By the way, the smell of early national elections has gotten stronger following recent regional polls.)

And I’m not sure that the rebound in French business and consumer confidence in September is likely to survive the new government’s pre-budget communications blitz stressing the need to reduce the deficit.

Put another way, the September ECB staff projections for real GDP growth in the second half of the year (0.2% sequentially for both Q3 and Q4) now look even more optimistic.

(Nor do I think that China’s package will be a game changer for its economy – never mind Europe’s.)

So I don’t have a problem with the notion of a 50bp cut in December, provided (services) inflation plays along of course.

In any case, I think if there’s no cut in October, market pricing is likely to shift further towards 50bp for December. It could be that between now and the meeting, the risk-reward emerges to pay October and receive December.

Worries

Last but not least, I have two concerns.

Or rather, one-and-a-half – because the second one follows from the first.

Consumers aren’t spending their real wage increases.

The ECB’s, and just about everybody else’s (myself included) growth narrative was based on consumers feeling the increase in real incomes as a result of lower inflation, and spending it. Instead, households have increased saving.

If this remains temporary, we’ll avoid a meaningful recession.

If it doesn’t, we have a bigger problem.

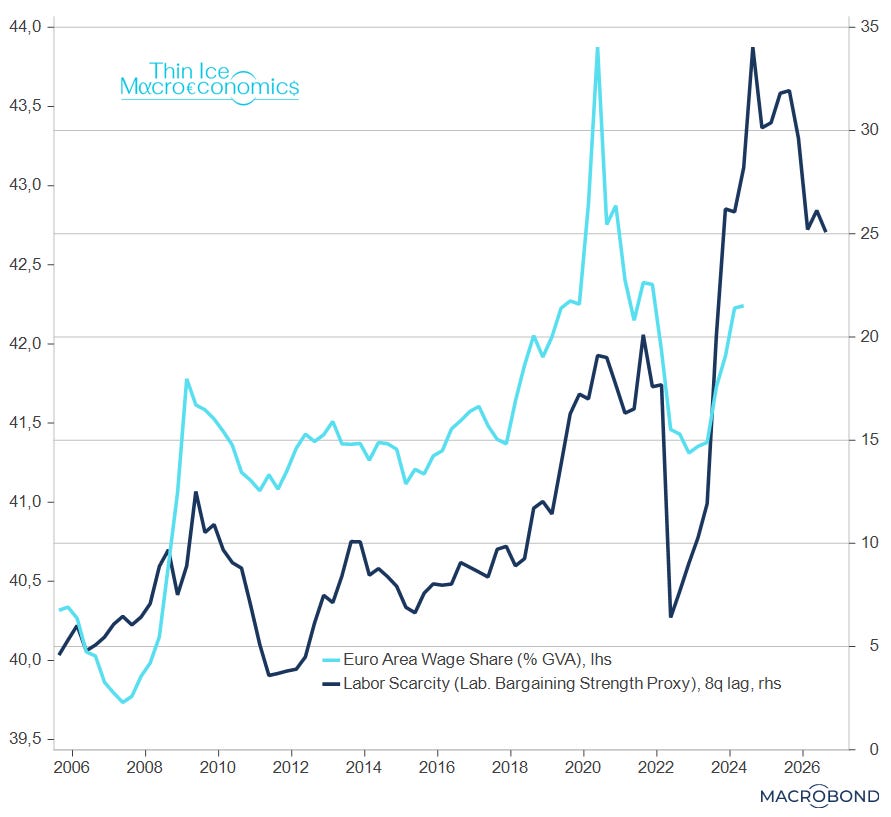

Regular readers may recall my analysis showing that labour market tightness, by increasing the bargaining power of workers, increases the share of national income accruing to them (the wage share of GDP).

source: ECB, Macrobond, Thin Ice Macroeconomics

However, this is predicated on people spending the higher wages. If they don’t, companies face an increase in labor cost without a matching increase in sales, a classic cost-push shock. That’s a recipe for layoffs - the labor market would then un-tighten via higher unemployment.

But I’ll come back to this another time.

For today, a reminder to myself: don’t take central bankers’ words too literally. They’re all Keynes’ disciples.

For questions or feedback, please comment or email me: s.andreopoulos@gmail.com